News for deferred members

Discover the latest news that matters for deferred members of the Fund.

Revaluation of your deferred pension

Deferred pensions are often referred to as frozen pensions. But that’s a bit misleading, as they receive increases every year to protect their value from being eroded by inflation.

Most deferred pensions are increased yearly by a minimum level known as Statutory Revaluation. This is published each November by the Government, and it tells schemes like the Fund how much we need to increase your pension. There are different increases for pension earned up to 5 April 2009 and pension earned from 6 April 2009.

In addition, if you earned pension before 6 April 1997, your deferred pension is likely to include a Guaranteed Minimum Pension. This is increased by a fixed rate each 6 April, and the rate depends on the date that you became deferred in the Fund.

For more detailed information, please see our deferred pension Revaluation Guides. We update these guides every year at the end of November on the member website.

Deferred Revaluation Guide for members of the Rolls-Royce Pension Fund section

Deferred Revaluation Guide for members of the Engine Control Systems section

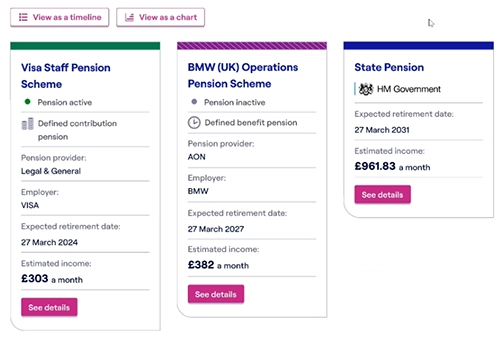

Coming soon – Pensions Dashboards

Pensions Dashboards will allow you to see an overview of all your UK pension memberships in one place – handy if you’ve been in quite a few different schemes. As you’d expect, we’re making plans to connect to the Dashboard platform. This means that we’ll be able to send information about your Fund membership directly to your Dashboard account whenever you request it.

If you’re worried about your personal information being stored on another database, don’t be. Your data will only travel from the Fund to your Dashboard account when you sign up for an account and ask to connect with us. It won’t be held on a separate system.

For the latest news visit www.pensionsdashboardsprogramme.org.uk

An example of how the Dashboard might look

Find out what your pension’s worth

There’s no need to send us an email or call us for a pension quote. Our online estimator at www.rolls-roycepensions.com provides quotations of your benefits at any date into the future, helping you plan for your retirement.

You can run unlimited quotes for early, normal or late retirement. And as there’s no limit on how many quotes you can get online, it’s worth putting time aside to try different dates and consider all of your options.

When you’re seriously considering taking your benefits, you can request a formal quotation up to two months in advance, allowing you to start planning your retirement and to select your bespoke option.

Once you’ve made your decision, everything is dealt with online, including age and identity checks.

Log in and head to the Get an Estimate page of the website to get started.

If you’ve registered before but have forgotten your pension number or password, just follow the instructions on the login screen to recover your account. And if you’ve not registered yet, our handy registration guide shows you how to do it.

Retirement advice from WPS Advisory

You wouldn’t buy a new house without seeking professional help to protect your big investment, so why go it alone when it comes to retirement?

That’s why the Trustee recommends you take independent retirement advice before deciding on your options. To support you, they’ve appointed a leading advice firm, WPS Advisory, to help you navigate your way to a better retirement.

In some cases, the retirement advice service is completely or partly funded by Rolls-Royce and the Trustee – and where it’s not, their rates are heavily discounted.

Retirement advice fees for current Rolls-Royce employees

Retirement advice fees for former Rolls-Royce employees

All members can register for this service online when requesting a formal quote at www.rolls-roycepensions.com, and you can find out more on the Retirement Planning & Financial Advice page.

If you decide to use your own financial adviser, make sure you know what they charge for defined benefit pension advice and what service they’re offering you.

Stay scam safe

Your pension is very attractive to criminals. Pension scams are constantly evolving and have devastating effects on their victims.

Pauline Padden, a nurse who lost all of her pension savings to fraudsters, speaks about the lasting impact of being scammed, and warns others not to fall victim.

For more information, please read the ‘Steps to stay scam safe’ leaflet.

Above all, if you’ve started to move your pension out of the Fund and become concerned about anything, contact us immediately for help.

Minimum Retirement Age

From 6 April 2028, the Government is amending the age at which you can start to receive retirement benefits from 55 to 57 years of age. However, your minimum retirement age in the Fund is protected from this change.

Rolls-Royce Pension Fund Section members retain their minimum retirement age of 50, and for all other members, it will still be 55 years of age.

Not all Fund pensions can be taken early. Full details are provided on the Get an Estimate page at www.rolls-roycepensions.com

Lump Sum Allowance (LSA)

The Lump Sum Allowance, introduced when the Lifetime Allowance was abolished on 5 April 2024, remains pegged at £268,275.

So, while there’s now no limit on the amount that you can build up and receive as income in retirement, the LSA caps the amount of tax-free cash that you can have from the Fund. The only exception to this is if you previously held HMRC protection in respect of the Lifetime Allowance, which may entitle you to a higher amount.

The Lump Sum and Death Benefit Allowance (LSDBA) also remains fixed at £1,073,100. This is a cap on the amount of tax-free cash that can be paid either to or in respect of you. The key difference between this and the LSA is that the LSDBA also includes any lump sum benefits that are payable after your death.

Our Lump Sum Allowances factsheet gives more detail and some examples of how these allowances work in practice.

Annual Allowance

The Annual Allowance (AA) is a limit on the level of retirement savings you can make in any tax year. As a Fund member, you’re no longer using any of your AA entitlement.

However, if you were an active member when the Fund closed on 31 December 2020 and you’ve exceeded the AA in your current pension scheme, you should contact us to find out how much of your AA you used up in the three tax years 2021/22 - 2023/24. This is because the AA allows you to carry forward unused allowance from the previous three tax years.

Find out more about the Annual Allowance on the MoneyHelper website.

Equalisation update

Regular newsletter readers will know that the pensions industry has been trying for a long time to comply with various court rulings around pension equalisation.

There are two equalisation issues affecting the Fund: Barber equalisation and GMP equalisation. This article explains what they are and what we’re doing to equalise pensions.

Barber equalisation

Pension schemes used to provide different normal retirement ages for men and women. This mirrored the way that the State Pension used to work, with an earlier retirement age for women.

In 1990, the European Court of Justice ruled that equal pay rules for men and women should also apply to pension schemes. They didn’t require schemes to make retrospective adjustments but ruled that from 17 May 1990, equalisation of retirement ages was required.

The period between this date and the date that individual schemes changed their rules to equalise retirement ages is known as ‘the Barber window’ (Barber being the surname of the person who brought the complaint to the courts). Many schemes (including the Fund) took steps to deal with this issue, but further court rulings continued to move the goalposts.

In our last update, we told you that the Trustee and its advisers had agreed a way forward to fix this problem. We’re pleased to report that we’ve now updated the pension records of all affected members, so when you get an estimate of your benefits on our website, it’ll reflect any update that we’ve had to make.

Guaranteed Minimum Pension equalisation (GMPe)

Most members of the Fund who joined before April 1997 will have a Guaranteed Minimum Pension (GMP) as part of their entitlement. This was a result of being ‘contracted out’ of part of the State Pension system. Like the State Pension, GMPs were also not equalised.

After many years of uncertainty, the High Court ruled that GMPs earned between 17 May 1990 and 5 April 1997 also needed to be equalised.

We’re expecting to fully implement GMPe during 2026, and if you’re affected, we’ll write to you directly with full details.